R&D tax credit specialists FAQs

VIDEO FAQ's

The need-to-know of R&D tax credit claims.

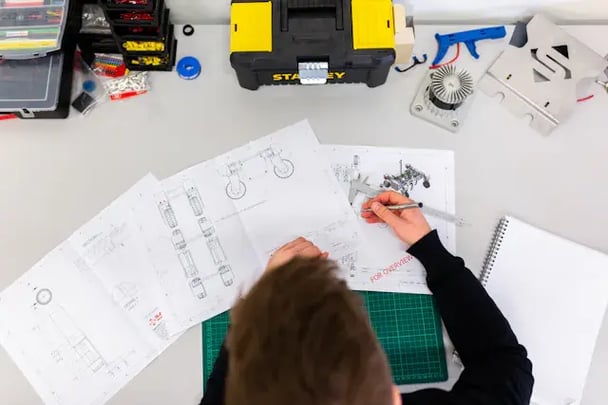

Why should I use R&D tax credit specialists?

Using R&D tax credit specialists, such as those at Queen's Lane Consultants, ensures your claim is accurate, maximised and compliant with HMRC guidelines.

How can R&D tax experts help my business?

R&D tax experts, including our team at QLC, identify eligible projects, prepare documentation, and submit claims, ensuring you get the most from your R&D investments.

What makes Queen's Lane Consultants different from other R&D tax companies?

Queen's Lane Consultants offers a bespoke, technology-driven approach, providing faster and more flexible R&D tax credit consulting services compared to traditional firms. Find out more about why you should choose QLC.

How do I know if my business qualifies for R&D tax relief?

Our R&D tax advisors can assess your projects to determine eligibility. Generally, if your business is involved in developing new or improved products, processes, or services, you may qualify.

What is the role of an R&D tax advisor?

An R&D tax advisor helps you navigate the complexities of the R&D tax credit application process, ensuring compliance and maximising your claim.

Are there specific benefits to using R&D tax relief specialists?

Yes, R&D tax relief specialists bring expertise and experience, ensuring that claims are thorough, accurate, and optimised for the best financial outcome.

Can R&D tax credit experts assist with defending claims against HMRC enquiries?

Absolutely. Our R&D tax credit experts at Queen's Lane Consultants are equipped to defend your claims and handle any HMRC enquiries on your behalf.

ACCOUNTANTS

Built with accountants in mind.

Retain clients by connecting them to the fastest, end-to-end R&D tax credit claims service in the UK. (And get a referral fee.)